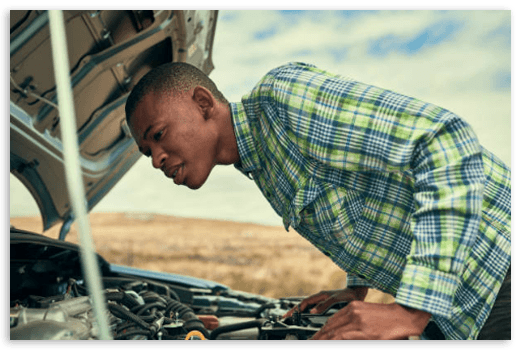

Auto Insurance

Choosing the right auto insurance is the key to keeping you and your car safe on the road in the event of an accident or other vehicle damage.

Home Insurance

Look after your biggest investment and everything in it with a proper policy that ensures its protection in the event of an accident or natural disaster.

Home & Auto Combined

By combining home and auto policies, you may be eligible to receive money-saving discounts, a guaranteed full-year policy term for your car, 24-hour Customer and Claim service, and more.

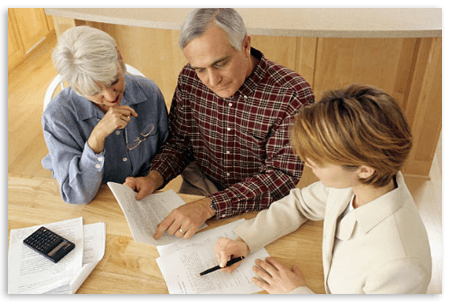

Personal Insurance

Keep your confidential information and personal assets secure with extended coverage options including personal umbrella insurance.

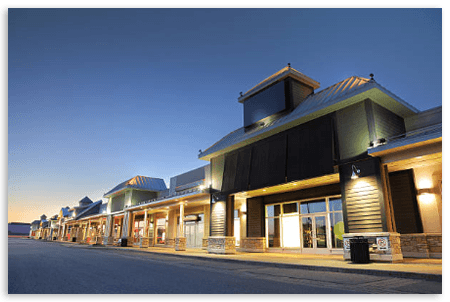

Business Insurance

Keep your business running smoothly with a commercial insurance policy that covers everything from your property to your employees.

Farm Insurance

Keep your farm running smoothly with a farm policy that covers everything from your crops and equipment to your structures and dwellings.

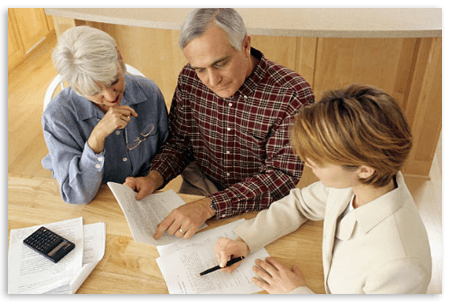

Life Insurance

Provide your family with the security they deserve in the event of your passing with a life insurance policy that meets your financial and personal needs.

Health Insurance

Making good decisions today can secure a healthy tomorrow for your family with individual or group plans designed to meet your specifications.

Liability Coverage

Safeguard yourself from financial worry due to injury or property damage if you are at fault in an accident.

Comprehensive Coverage

Be prepared for any non-collision oriented accidents by adding Comprehensive Coverage to your Auto policy.

Collision Coverage

If you're involved in an accident with another vehicle or object and your car is damaged, Collision will help you pay for repairs.

Uninsured & Under-insured Motorist Coverage

Protect yourself, your passengers, and your vehicle in the event of a collision with an uninsured or under-insured driver.

Diminishing Deductible

Get rewarded for being accident and violation free with credit towards collision deductibles to help you save.

Accident Forgiveness

Find out how you can qualify to have your first chargeable accident forgiven -- so your rates won't go up.

Roadside Assistance

Sign up for a basic or premium Roadside Assistance package and receive extended towing, flat tire service and much more.

Rental Reimbursement

Don't let an unforeseen accident keep you out of commission. With Rental Reimbursement, you can get back on the road in no time

Minor Violation Forgiveness

Safe drivers deserve a second chance, and with Minor Violation Forgiveness, your rates won't increase due to a minor traffic citation.

Specialty Auto Insurance

A vehicle as unique as its driver requires more than a basic Auto policy. Make sure your Specialty Auto is protected.

24-Hour Customer Service

Get the attention you need when you need it most with 24/7/365 service at your convenience for accidents, claims, billing and more.

Medical Payments Coverage

Your family is important. If an accident should occur, make sure their medical expenses are taken covered.

Towing

Don't let an unexpected breakdown leave you stranded. Towing support provides emergency Roadside Assistance when you need it most.

Personal Injury Protection (PIP)

With the right coverage options, you and your passengers can be on the road to recovery after an accident.

Property Insurance

Ensure the safety of your home, your family, and your personal belongings against loss from damage, theft, and more.

Mobile Home Insurance

Protect your mobile home and personal property with coverage designed to work specifically with you and your budget.

Homeowners Liability

If someone is injured on your property, make sure your home and personal finances are secure with Homeowners Liability.

Scheduled Property Insurance

Safeguard your most precious possessions under a Scheduled Property Insurance policy to preserve your peace of mind.

Renters Insurance

Keep your belongings and the memories they hold safe with a Renters Insurance policy that won't break your budget.

Landlords Insurance

Secure the value of your rental property with a policy that covers your building in the event of damage and keeps you safe from liabilities.

Condo Insurance

Ensure the safety of your home and belongings with specialized insurance to meet your needs as a condo owner.

In-Home Business Insurance

Give yourself the financial security and peace of mind knowing that your in-home business operations are protected.

Identity Theft

In the event that your identity is stolen, ID Theft insurance can help restore your financial security and your peace of mind.

Personal Umbrella Insurance

Prepare for situations that extend beyond your standard Home and Auto liability with a Personal Umbrella policy for high-cost damages.

Data Backup

With Data Backup services, you can rest easy knowing that your important documents and files are safe from unexpected technology accidents.

Commercial Property Insurance

Keep your business and its property secure with the right policy to help pay for minor accidents and major losses.

Commercial Umbrella Insurance

Get the extra layer of protection your business needs when a lawsuit exceeds the limits of your current business liability.

Commercial General Liability

Safeguard your business from financial loss with a policy that takes care of medical expenses, attorney fees, damages, and more.

Professional Liability

Preserve your business' finances against legal claims made in the event of minor or serious mistakes or errors.

Business Owners Policy (BOP)

Combine Property, Liability, Crime, and additional insurance services into one convenient policy to benefit your small to medium-sized business.

Workers Compensation

Protect your business from employee expenses resulting from work-related accidents and injuries.

Inland Marine Insurance

Arm your business against potential loss to your products and equipment while working or traveling off-site.

Crime Insurance

Prevent crime and employee dishonesty from disrupting your business with a specialized policy to safeguard your assets.

Commercial Auto Insurance

Keep your commercial vehicles insured with a policy that covers your property, products, and employees in the event of an accident.

Crop Insurance

Ensure the continued operation of your farm or ranch against financial loss from crop damage and lost revenue due to natural disasters.

Farm Dwelling Insurance

Safeguard your farm residence and rental properties against damage expenses with Dwelling Insurance coverage.

Farm Owners Insurance

Take care of your farm and your home with a comprehensive policy to cover everything from Dwelling and Personal Property to Liability.

Farm Structures Insurance

Protect yourself against potential loss to the buildings and property that make up the foundation of your agribusiness.

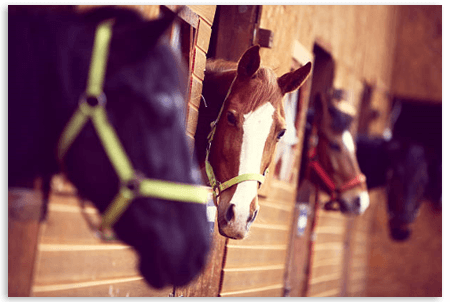

Farm Livestock Insurance

Protect your farm from financial loss with Livestock Insurance to cover the value and health of your animals.

Farm Auto Insurance

From your personal truck to your animal trailer, keep the vehicles you rely on secure with a proper Farm Auto policy.

Equine Insurance

Ensure the value of your equine investment against financial loss due to injury, loss of use, infertility, or death.

Farm Umbrella Insurance

In the event a serious accident or legal dispute exceeds your general liability, ensure the security of your farm assets with Farm Umbrella insurance.

Farm Equipment Insurance

Alleviate yourself from the financial burden of having to replace expensive farm equipment out of your own pocket

Farm Liability Insurance

Arm yourself against financial loss resulting from claims of property damage or bodily injury to others on your farm or ranch.

Individual Life Insurance

Guarantee the financial security of your family in the event of your passing with Individual Life Insurance designed to fit your needs.

Disability Insurance

If an injury or illness leaves you incapable of working, a Disability Insurance policy can pay benefits to compensate for lost income.

Group Life Insurance

Round out your employee benefit package with an affordable Group Life plan that benefits you and your employees.

Second-To-Die Policy

Protect your wealth and keep personal assets in the family with a Second-to-Die policy that can be used to pay heavy estate taxes.

Long-Term Care Insurance

Safeguard your family's financial future while receiving extended medical attention when you need it most

Key Person (Key Men) Insurance

Minimize the financial impact of losing an important figure of your business with Key Person Life Insurance.

Mortgage Protection Insurance

In the event of your unexpected passing, the proper Mortgage Protection policy can help pay off your existing mortgage debt.

Individual & Family Health

Avoid costly medical expenses by keeping you, your spouse, and your children protected under the same plan.

Supplemental Insurance

Ensure that you're covered for situations outside your existing Health policy with additional insurance that keeps your finances secure.

Group Health Insurance

Provide your employees with the benefits and coverage options they deserve with an affordable Group Health Plan.

Disability Insurance

If an injury or illness leaves you incapable of working, a Disability Insurance policy can pay benefits to compensate for lost income.

Dental Coverage

Provide your employees and your family with quality Dental benefits, including plans such as Traditional Indemnity, DHMO, and PPO.

Medical Expense Insurance

Prevent paying large, out-of-pocket expenses with a policy that protects against illness, injury, or catastrophe.

Vision Coverage

Keep your employees and your family covered from paying large, out-of-pocket expenses associated with critical optical needs.

Child Health Insurance

While not everyone can afford insurance, there are still ways that you can get your child the care he or she needs.

Long-Term Care Insurance

Safeguard your family's financial future while receiving extended medical attention when you need it most.

Prescription Insurance

To avoid feeling the burden of high prescription drug costs, get the medication you need at a fair price with Prescription Insurance.

Temporary Health Insurance

If you have a gap in your current Health Insurance policy, make sure you're protected from unexpected injury and illness.

HSAs

For high-deductible health plans, set money aside for medical expenses in an account that's tax-free and rolls over each year.